Exploratory analysis

After loading input data, need to explore it in order to

double-check if the data was loaded and prepared correctly

examine the range and the distribution for forecasts and actuals

detect possible outliers or unexpected cases, the presence of zero cases, negative cases, missing actuals and the frequency of such cases

Eventually, at this step we want i) to confirm that the data is of appropriate quality for measuring accuracy performance and ii) to choose the error metrics that correspond to the features of the data.

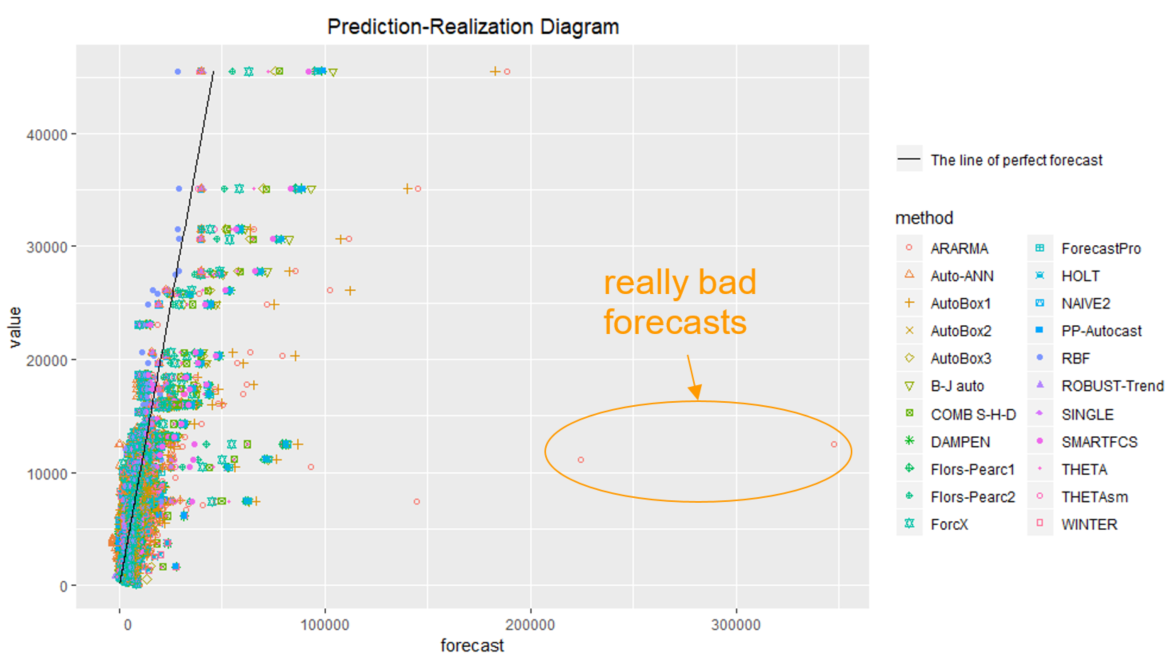

To explore the distribution of actuals and forecasts, let’s use the prediction-realization diagram.

# load yearly M3-data

# load time series actuals

library(forvision)

ts <- m3_yearly_ts

# load forecasts

fс <- m3_yearly_fc

# create a dataframe containing both actuals and forecasts formatted using the AFTS format

library(forvision)

af <- createAFTS(ts, fc)

# plot the prediction-realization diagram

plotPRD(af)The graph spots some really unwanted cases when forecast seriously overestimated actuals. E.g., having a forecast close to 350,000 units we had actual of only about 11,000 units. We also observe negative forecasts while actuals are always non-negative.

Let’s take a closer look at the “really bad forecasts” spotted. With the AFTS format we can slice-and-dice forecast data in order to find the details:

subset(af, forecast > 100000)## series_id category value timestamp method_id forecast horizon origin_timestamp

## 14862 Y113 MICRO 7475.00 1992 ARARMA 144595.0 4 1988

## 14884 Y113 MICRO 11160.00 1993 ARARMA 224119.6 5 1988

## 14906 Y113 MICRO 12505.00 1994 ARARMA 347381.2 6 1988

## 43810 Y332 FINANCE 26099.16 1993 AutoBox1 112117.0 6 1987

## 43814 Y332 FINANCE 26099.16 1993 ARARMA 102439.7 6 1987

## 44030 Y334 FINANCE 30636.26 1991 AutoBox1 107644.4 4 1987

## 44034 Y334 FINANCE 30636.26 1991 ARARMA 111450.1 4 1987

## 44052 Y334 FINANCE 35104.84 1992 AutoBox1 140253.9 5 1987

## 44056 Y334 FINANCE 35104.84 1992 ARARMA 144957.9 5 1987

## 44073 Y334 FINANCE 45525.66 1993 B-J auto 103875.3 6 1987

## 44074 Y334 FINANCE 45525.66 1993 AutoBox1 182804.6 6 1987

## 44078 Y334 FINANCE 45525.66 1993 ARARMA 188824.7 6 1987

For series_id=’Y113’ one of the actuals is 7475.00, while the corresponding forecast is 144595.0 – a huge forecast error. Let’s show this forecast on the graph.

First, in order visualization tools to work correctly, we must prepare appropriate time-based object timestamp columns for the data_ts and data_fs:

library(zoo)

ts$timestamp_dbo <- as.yearmon(ts$timestamp, format = '%Y')

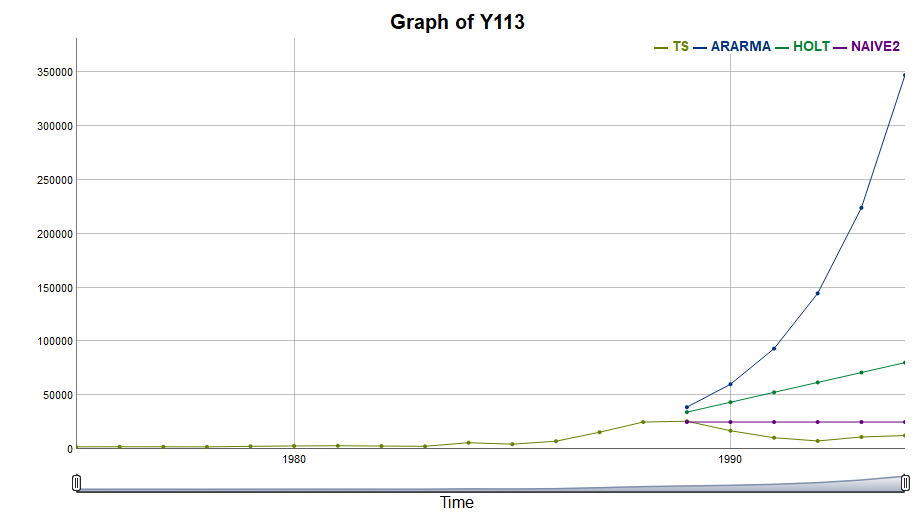

fc$timestamp_dbo <- as.yearmon(fc$timestamp, format = '%Y')Then we can show forecasts produced at origin=1988 using a set of methods (say, “ARARMA”, “HOLT”, “NAIVE2”) using the fixed origin graph:

plotFixedOrigin(ts, fc, "Y113", 1988, c("ARARMA", "HOLT", "NAIVE2"))

Method “ARARMA” are performing quite badly since it tend to extrapolate trends that do not hold in subsequent periods. Thus, the prediction-realization diagram together with the fixed origin graph helped identify the risks associated with using some methods like “ARARMA”. However, it’s just how the forecast methods works like, so there are no unexpected cases here.

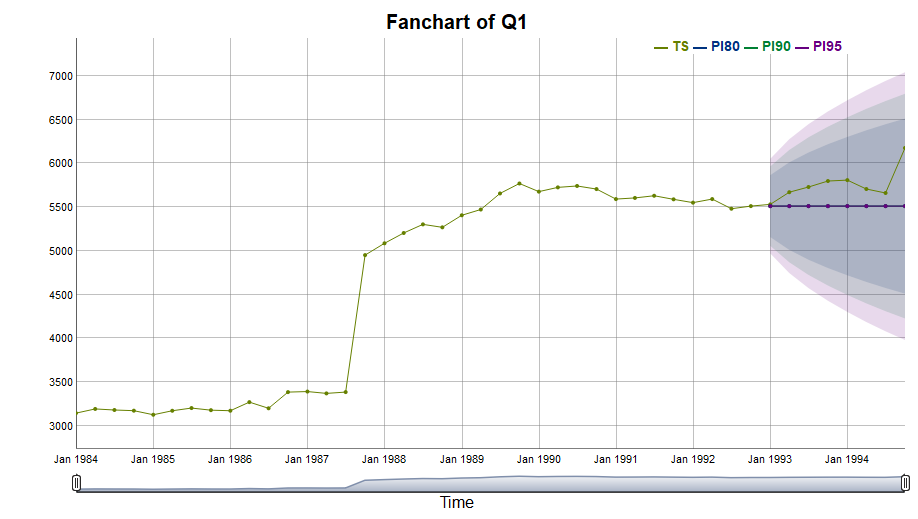

When working with interval predictions, we may want to visualize the forecast uncertainty using the fan chart.

# load quarterly M3-data

# load time series actuals

ts <- m3_quarterly_ts

# load forecasts

fc <- m3_quarterly_fc_pis

# prepare appropriate time-based object timestamp columns for the data_ts and data_fs

library(zoo)

ts$timestamp_dbo <- as.yearqtr(ts$timestamp, format = '%Y-Q%q')

fc$timestamp_dbo <- as.yearqtr(fc$timestamp, '%Y-Q%q')

# plot a fan chart

plotFanChart(ts, fc, "Q1", "1992-Q4", "ARIMA")

After visual exploration of the input data and confirming that it is of appropriate quality, we can proceed to applying formal techniques to measure forecasting performance and compare alternative forecasting techniques.

To cite this website, please use the following reference:

Sai, C., Davydenko, A., & Shcherbakov, M. (date). The Forvision Project. Retrieved from https://forvis.github.io/

© 2018 Sai, C., Davydenko, A., & Shcherbakov, M. All Rights Reserved. Short sections of text, not exceed two paragraphs, may be quoted without explicit permission, provided that full acknowledgement is given.